The sneaker resale market is a $6 billion industry in the U.S. and projected to grow even more, but is facing a new challenge: tariffs. Under the Trump administration, tariffs on imports from Vietnam and China—two major manufacturing hubs for sneakers—have increased significantly, with rates as high as 46% on Vietnamese goods and 54% on Chinese imports. These changes could profoundly affect sneaker brands, resellers, and consumers.

Sneaker Prices on the Rise?

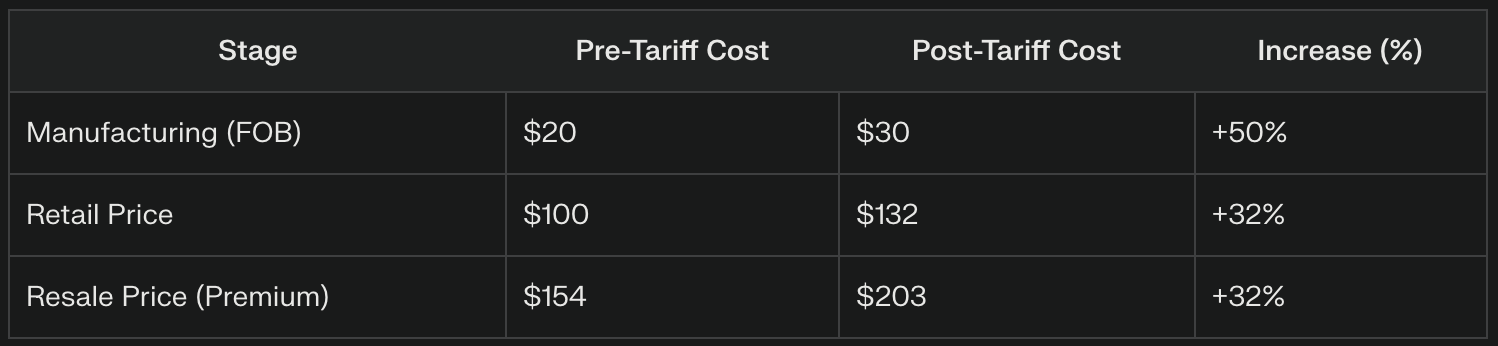

The most immediate impact of these tariffs is higher costs for sneaker production, which will inevitably trickle down to consumers. Here’s a breakdown of the potential price increases:

For sneaker resellers, this means higher retail prices will lead to inflated resale prices. Limited-edition sneakers that already command high premiums may become even more expensive, potentially alienating budget-conscious buyers.

Challenges for Resellers

The sneaker resale market thrives on exclusivity and scarcity. Platforms like StockX, GOAT, and eBay facilitate transactions where rare sneakers often sell for double or triple their retail price. However, the new tariffs introduce several challenges:

This combination of factors could lead to fewer transactions on resale platforms and a slowdown in market growth.

The Ripple Effect on Market Dynamics

The sneaker resale market has been growing rapidly, with online platforms like StockX and GOAT accounting for about 50% of all transactions. However, tariffs could disrupt this trajectory:

To illustrate the ripple effect of tariffs across the supply chain, here’s a simplified cost breakdown:

This table demonstrates how compounded cost increases affect every stage of the sneaker lifecycle—from production to resale.

How Brands and Resellers Might Adapt

Faced with these challenges, both brands and resellers are exploring strategies to mitigate the impact of tariffs:

What’s Next for Sneaker Reselling?

Trump’s tariffs are poised to reshape the sneaker industry by driving up costs across retail and resale markets. While large brands like Nike and Adidas have the resources to absorb some of these impacts or shift production strategies, smaller resellers may struggle to adapt. For consumers, this means paying more for coveted sneakers—or turning away from premium products altogether.

For sneaker enthusiasts and investors alike, navigating this new landscape will require adaptability and creativity. Whether it’s through innovative pricing models or shifts in consumer behavior, the sneaker resale market must evolve quickly to weather this storm.

Found this valuable?

Share it with your network